A very large proportion of Poles have a loan or credit, often more than one. Banks and financial institutions offer a solution for holders of many debts. It is a consolidation loan.

What is a consolidation loan?

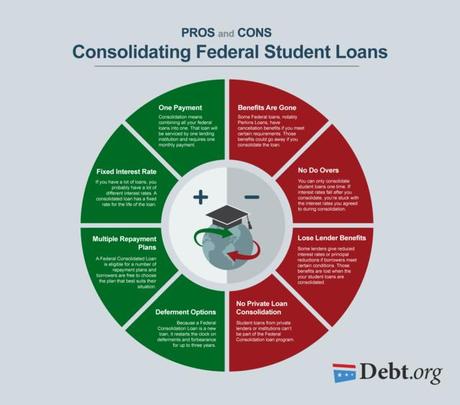

A consolidation loan is nothing more than a combination of many loans into one. Thanks to this, instead of paying many installments, you only pay one. When deciding on this type of loan, financial institutions offer a lower installment than you pay so far, a uniform interest rate and repayment period. You can consolidate virtually any type of loan from mortgage to car.

Advantages of a consolidation loan

A consolidation loan can certainly help you get out of serious debt. Its main advantages include, above all, lower installments, which will undoubtedly help rebuild your home budget. Thanks to this, you can save up to $ 200-300 per month. Another advantage is the lower interest rate. This is another way to save money. The last thing you can gain is time. By choosing a consolidation loan you can extend the repayment period of all your debts.

Disadvantages of a consolidation loan

Lower installment, interest rate, longer repayment period - sounds great? Does the consolidation loan therefore have disadvantages? Both the advantages and disadvantages include an extended repayment period. It increases the number of interest you will have to pay the bank. Yes, it may offer you a lower installment, but in return for the repayment period, it will earn you more. You should also remember about additional costs, such as commissions, which generate additional expenses.

A consolidation loan can undoubtedly save you from huge debt. However, from the perspective of its duration, it can generate higher costs. Analyze your financial situation and choose the solution that will be the most for you.

Plan your choosen loan with us! Call now!