Predestined to be fuelling the industry’s major growth for years to come, China, along with the other BRIC markets, represents a strategic opportunity for luxury watch brands. If significant signs of recovery in sales have been announced by most of the industry’s leaders, it is largely due to the demand increase for Swiss watchmaking in these regions. They have become true ‘Eldorados’, not only for Swiss watchmakers, but for the luxury industry in general.

China represents the pillar of the current growth of the industry, with performance numbers that easily surpass those of the other emerging markets. This market is currently the third largest consumer of luxury goods, and will rank first by 2015.

China is currently the third largest consumer of luxury goods, and will rank first by 2015. Picture: People are crowed in the shopping mall to buy presents on Christmas Eve. (Photo/CFP)

Deciphering local preferences

Due to the vast expanse of the country and the multicultural diversity in the fast-growing affluent regions, it is difficult to draw up a standard profile of the typical Chinese consumer with regard to luxury goods demand, even though, “they need these goods to represent their own purchasing power and to taste psychological satisfaction” according to David Chang, Founder of the Research Office for Haute Horlogerie and China and WorldWatchReport Invited Contributor.

According to the online findings revealed in the past two years in the WorldWatchReport, the Chinese consumer is for the most part brand-name focused. He/she is influenced by the high-profile ambassadors who promote the brands, preferring those who personify excellence in competition in the world of sports. In addition, they are drawn to strength of character, as demonstrated even through fictional characters, such as James Bond. International cinema and television stars are emulated by the Chinese consumer, whether they are current or classic, male or female.

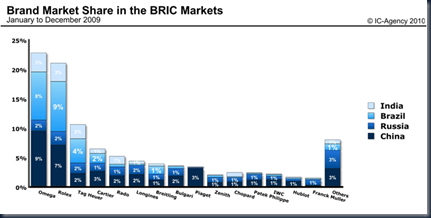

China is the leading market in terms of search volume for the BRIC markets. Omega and Rolex are much more searched for than any other brand, with a slight advance for Omega in China. High Range brands Longines and Rado perform especially well in China – © IC-Agency, WorldWatchReport 2010

Online brand building in China

China’s strategic importance has pushed Internet growth at the expense of print media. If brands would traditionally invest in magazines, they cannot replicate this recipe in China where the magazine market is constantly evolving and erodes any coherent or lasting image. While the Internet is considered the primary factor influencing purchasing, boutiques are considered to be in second position and magazines only in seventh (BCG Asia). Nevertheless, David Chang stresses that “the print Media’s advertisement is still a very important method to target Chinese Luxury goods consumers. But, with the development of the Chinese market, the online share will be more important. More people, including younger consumers, want to access watch knowledge rapidly, and the Internet is the most convenient way” .

In regards to the search for information, Baidu is the uncontested search engine leader with nearly two thirds of the search market share in China, far ahead of Google which seems unsuccessful in imposing its leadership in the Middle Kingdom. When deciphering the local clientele search behavior, it remains mostly brand-oriented due to the challenge for brands to translate and adapt their product ranges and campaign messages to the local languages and preferences. “China’s market is not very mature, many brands entered this market late and they have not yet been recognized. People mainly want to know about the different brands, their history and positioning. Moreover, many model names are not translated into Chinese, so it is not convenient for online searching. Though people know some names through watch advertisements, a limited amount of people recognize model names,” points out David Chang.

Example of a luxury brand visibility on Baidu – Cartier

When looking at watch aficionados’ online conversations, the Chinese clientele has no reason to be jealous of western watch platforms. Hundreds of thousands of watch enthusiasts participate actively in online forums dedicated to the art of fine watchmaking, such as Iwatch365.net, Watchbus.com or Watchstore.com.cn where page view statistics can range from one to three million per month. Besides discussions about world famous brands, style and technology of watches, a significant portion of some forums are dedicated to watch sales transaction, where people set up their shop page and sell watches online.

One of the key challenge for Swiss watch brands wanting to succeed in China will be to define the right online positioning which emotionally connects to China’s affluent clientele. While mapping its online media consumption would be the first step, mastering language specificities, clientele preferences as well as defining the appropriate engagement drivers are crucial success factors for luxury watch brands in China.

Source: Europa Star Dec. 2010 /Jan. 2011 Magazine Issue